In Chester County, there is a short window for property owners to fill out the Notice of Intention to Appeal their current annual assessments before the County Assessment Board. Hopefully the hearing panel will agree with the appeal, and reduce the assessed value. The assessment is the foundation which the taxing authorities use to determine the amount of real estate taxes based on their tax rates or millage rates. If you can have your assessed value reduced this year, it will, in effect, reduce your taxes for next year. The Chesco.org website has the forms and complete instructions on how to do this. Go to: Link to the County Appeal Page, Assessment Appeal F.A.Q.S, or Where do I get the forms?

The important things to know now are:

1.The time frame for requesting an appeal hearing appointment is May 1 – August 1

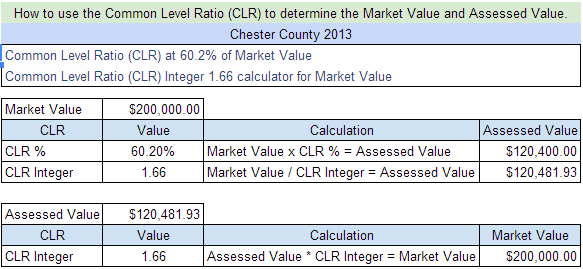

2. Your property assessment is a portion of your market value. That portion is called the “Common Level Ratio” The Tax Equalization Division has officially set the Chester County Common Level Ratio (CLR) at 49.3%. The CLR will be effective for all annual appeals heard by the Board of Assessment Appeals during 2019.

See the chart below to see how to calculate your market value. It is an example based on 2013’s CLR.

3. You will need to know your Market Value. If you have recently purchased your home and have an appraisal that was done within the last 12 months, the appraised value could be used as the Market Value. But if you don’t have a recent appraisal on your home, a Real Estate Agents like Ruth or Dana Parker can help you find the most recent sales of similar properties in your immediate area.

4. There is a processing fee of $25. that will need to be sent in with the filled out Notice of Intention of Appeal. These fees are for each parcel being appealed and a $50 fee is charged for preferential assessments.

5. On the Notice of Intention of Appeal, where it asks you to state your reason for making this appeal: put: TO APPLY THE CURRENT COMMON LEVEL RATIO.

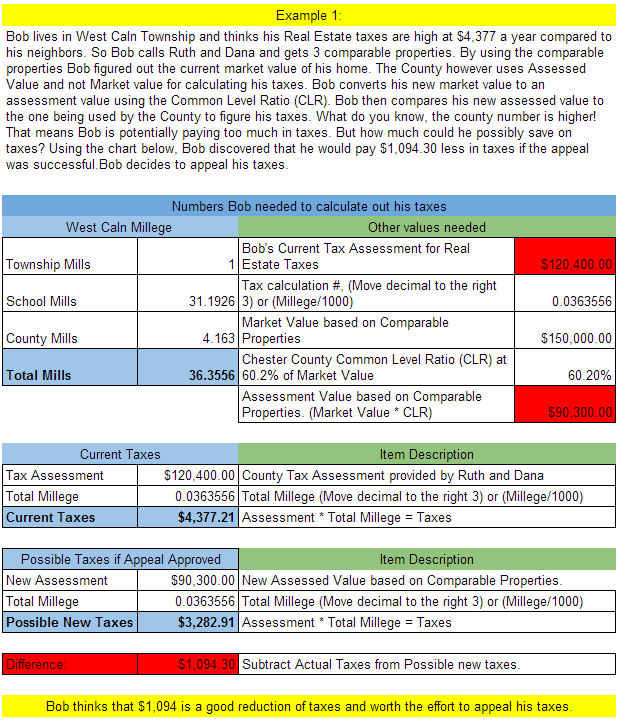

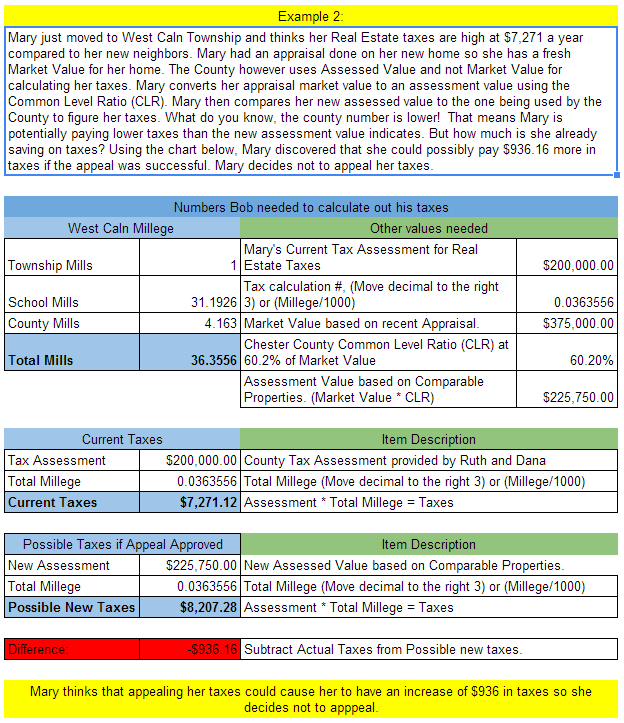

6. By appealing, you open your property to the re-valuation process in which your property assessment may be lowered, raised, or remain the same. BE SURE before sending it in that it is worth it. See the two examples here.

7. After they have received your Notice of Intention of Appeal, they will notify you of the time your 15 minute appointment will be to appear before the assessment board and state your case with proof. You will receive this notice in writing at least 20 days before the hearing. It is at this hearing that you present multiple copies of your comps and/or your appraisal and recent pictures of the front and back of your home.

8. If you go in with correct comparable sales to establish your market value, by law, you are entitled to have the “common level ratio” applied to your taxes.

9. If you need help finding the tax id number for your property or need help with the documentation of recent sales (comparables), feel free to contact Ruth or Dana Parker of the Parker Home Team of Keller Williams Real Estate in Exton.